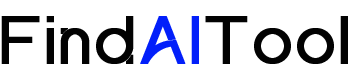

Insurance Policy AI is a powerful software tool designed to protect families and individuals from the potentially devastating consequences of insurance policy loopholes. By providing a comprehensive analysis of insurance policies, this innovative platform offers users unprecedented transparency and clarity regarding their coverage.

The software’s core functionality revolves around its ability to scrutinize insurance policies for potential discrepancies and loopholes. Users simply input their policy information, and Insurance Policy AI conducts a thorough examination, generating detailed reports and actionable recommendations. This process empowers users to address any identified issues, ensuring their policies provide the coverage they expect and need.

Key features of Insurance Policy AI include its advanced policy analysis capabilities, user-friendly interface, and the provision of clear, detailed reports. The software’s ability to identify and explain potential policy weaknesses sets it apart, offering users peace of mind and the opportunity to make informed decisions about their insurance coverage.

Insurance Policy AI caters to a diverse range of users, including families seeking comprehensive coverage, individuals looking to understand and improve their policies, and insurance professionals aiming to better serve their clients. For families, the software provides crucial protection against unforeseen policy gaps that could lead to financial hardship. Individuals benefit from a clearer understanding of their coverage, while insurance agents and brokers can utilize the tool to offer enhanced service to their clientele.

By leveraging Insurance Policy AI, users gain valuable insights into their insurance coverage, potentially saving them from significant financial and emotional stress in the future. This software not only demystifies complex insurance policies but also empowers users to take control of their coverage, ensuring they and their loved ones are adequately protected.