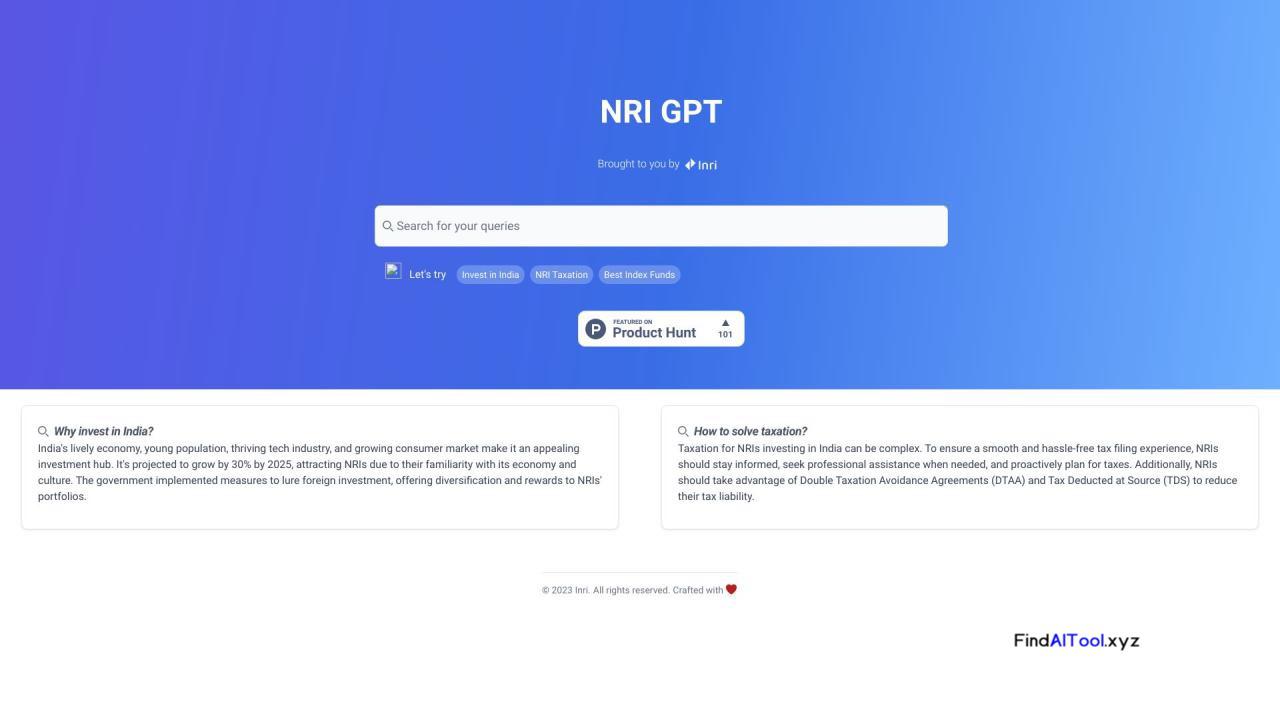

NRI GPT Product Information What is NRI GPT? NRI GPT is a chatbot powered by Open AI ChatGPT that provides answers to queries related to India investing and taxation. It is designed to assist Non-Residential Indians (NRIs) in understanding and navigating the complexities of investing in India and managing their taxes. How to use NRI GPT? To use NRI GPT, simply type in your query or question regarding India investing or taxation. The chatbot will generate relevant responses and provide you with information and guidance. You can ask about topics such as best index funds for NRIs, benefits of investing in India, taxation rules, Double Taxation Avoidance Agreements (DTAA), Tax Deducted at Source (TDS), and more. NRI GPT’s Core Features 1. India Investing: Get information on the best index funds, investment opportunities, and reasons to invest in India.2. NRI Taxation: Understand the complexities of taxation for NRIs investing in India, including tips to minimize tax liability.3. Double Taxation Avoidance Agreements (DTAA): Explore how NRIs can benefit from DTAA and reduce tax burden.4. Tax Deducted at Source (TDS): Learn about TDS and how it can help NRIs manage tax payments. NRI GPT’s Use Cases #1 1. NRIs planning to invest in India can use NRI GPT to gather insights into the Indian economy, tech industry, and consumer market, helping them make informed investment decisions.2. NRIs seeking guidance on taxation can rely on NRI GPT to understand the complexities of filing taxes in India, explore ways to minimize tax liability, and utilize DTAA and TDS provisions.3. Professionals and individuals providing financial advice or assistance to NRIs can use NRI GPT as a resource to access information and stay updated on India investing and taxation topics. FAQ from NRI GPT Why should NRIs invest in India? How can NRIs manage taxation while investing in India? What are the benefits of Double Taxation Avoidance Agreements (DTAA)? How does Tax Deducted at Source (TDS) help NRIs? NRI GPT Company NRI GPT Company name: Inri .

NRI GPT Product Information What is NRI GPT? NRI GPT is a chatbot powered by Open AI ChatGPT that provides answers to queries related to India investing and taxation. It is designed to assist Non-Residential Indians (NRIs) in understanding and navigating the complexities of investing in India and managing their taxes. How to use NRI GPT? To use NRI GPT, simply type in your query or question regarding India investing or taxation. The chatbot will generate relevant responses and provide you with information and guidance. You can ask about topics such as best index funds for NRIs, benefits of investing in India, taxation rules, Double Taxation Avoidance Agreements (DTAA), Tax Deducted at Source (TDS), and more. NRI GPT’s Core Features 1. India Investing: Get information on the best index funds, investment opportunities, and reasons to invest in India.2. NRI Taxation: Understand the complexities of taxation for NRIs investing in India, including tips to minimize tax liability.3. Double Taxation Avoidance Agreements (DTAA): Explore how NRIs can benefit from DTAA and reduce tax burden.4. Tax Deducted at Source (TDS): Learn about TDS and how it can help NRIs manage tax payments. NRI GPT’s Use Cases #1 1. NRIs planning to invest in India can use NRI GPT to gather insights into the Indian economy, tech industry, and consumer market, helping them make informed investment decisions.2. NRIs seeking guidance on taxation can rely on NRI GPT to understand the complexities of filing taxes in India, explore ways to minimize tax liability, and utilize DTAA and TDS provisions.3. Professionals and individuals providing financial advice or assistance to NRIs can use NRI GPT as a resource to access information and stay updated on India investing and taxation topics. FAQ from NRI GPT Why should NRIs invest in India? How can NRIs manage taxation while investing in India? What are the benefits of Double Taxation Avoidance Agreements (DTAA)? How does Tax Deducted at Source (TDS) help NRIs? NRI GPT Company NRI GPT Company name: Inri .